Why are contractors moving away from Quickbooks?

The contracting business is very competitive so successful contractors are turning to construction specific job cost accounting software to:

- Control Costs,

- Manage Cash Flow and

- Provide More Accurate Financial Reporting

Controlling Costs

Job costing is an important aspect of controlling cost but without up-to-date budgets you have no control.

Successful contractors are investing in job cost accounting software that tracks actual to budgeted cost by category of work. They also understand budgets change during construction so it’s important that these budgets are updated in their system.

A good job cost accounting system will track the actual cost to the original budget, change order and revised budget. They will provide over budget warnings at the time of entering vendor invoices, which will also control costs up front rather than after the fact.

Managing Cash Flow

Managing cash flow is another important aspect of running any business. For contractors, the best way to manage cash flow is to make sure client billings are generated on a timely fashion so you can get paid faster. You should also track your accounts receivable and your payable.

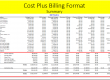

A construction specific accounting system will help you manage the cash flow by expediting the billing process. They will also track your accounts receivable & payable by job and allow you to select vendor invoices to pay by job so when you get paid you can easily generate vendor payments.

Generating more Accurate Financial Reports

Creating balance sheets and profit & loss statements is a great way to manage any business. Unfortunately, for contractors, the profit and loss reports are typically never correct. The reason is because if you processed your payroll today you would probably see a negative net profit. The opposite is true if you generated client billings. This is where construction companies need a system that generates work-in-process reports. Basically, a work-in-process is a profit and loss report for “Open” Jobs. The report typically includes the following information: Revised Contract Amount, Job % Complete, Earned, Billed Amount, Over/Under Billed, Cost to Date, Project Total Cost, Projected Profit/Loss, Cost to Complete and Contract Balance.

The most important number is the “Over/Under Billed” amount. If you add the total “Over/Under Billed” amount for all jobs to your net profit on your P&L statement you would have a more accurate understanding of your true net profit.

Note: A work in process report uses budgets to calculate the percentage of completion so if your budgets are not up-to-date neither will be your work-in-process reports.

The Solution!

Contractors Software Group offers three series of job cost accounting systems for contractors based upon size, needs and budgets. They all help control cost overruns, improve cash flow and generate more accurate financial statements and work-n process reports to run a successful construction company.

For more information on Contractors Software Group’s job cost accounting software for home builders go to: https://contractorssoftwaregroup.com/job-cost-accounting-software/

You’ll be glad you did!